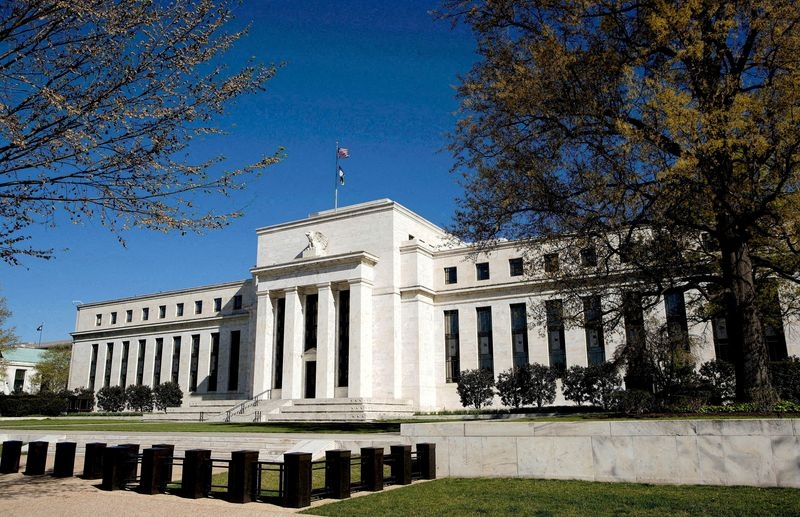

(Reuters) – Global investors ploughed money into equity funds in the week to Aug. 21, encouraged by expectations of a Federal Reserve rate cut in September and easing concerns about the U.S. economy.

According to LSEG data, investors snapped up $15.73 billion worth of global equity funds during the week, marking their largest weekly net purchase since July 17.

Expectations of Fed rate cuts soared as the latest meeting minutes revealed that a majority of policymakers support a September interest rate cut if the data aligns with expectations.

Investors are now poised for Fed Chair Jerome Powell's upcoming remarks on Friday at the Jackson Hole Economic Symposium, seeking confirmation that the Fed will proceed with the anticipated rate cut.

Meanwhile, strong U.S. retail sales data, upbeat consumer sentiment numbers and a benign inflation reading last week signalled a robust economic footing, boosting investor appetite, despite earlier fears of a sharp slowdown sparked by a disappointing jobs report at the start of the month.

Investors placed $5.97 billion into U.S. equity funds, the biggest amount in five weeks. European and Asian funds also gained $5.55 billion and $4.39 billion, respectively in inflows.

The technology and consumer staples sectors booked net inflows of $931 million and $825 million, respectively, while utilities suffered a significant outflow of $612 million.

Global investors bought bond funds for a 35th successive week on a net basis, allocating about $11.29 billion, the largest amount in three weeks.

They funnelled a net $2.96 billion into corporate bond funds, the most in five weeks, and added about $2.71 billion worth of government bond funds, but discarded a net $336 million worth of loan participation funds.

Gold and other precious metal funds saw the sharpest demand in about 2-1/2 years as they received $1.5 billion of inflows during the week. Investors also acquired a net $138 million of energy funds, broadly reversing a $193 million outflow during the prior week.

Data covering 29,604 emerging market funds showed equity funds lost $679 million, as outflows continued for an 11th successive week. In contrast, bond funds remained popular for the ninth consecutive week, with about $531 million in net purchases.

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Sharon Singleton)